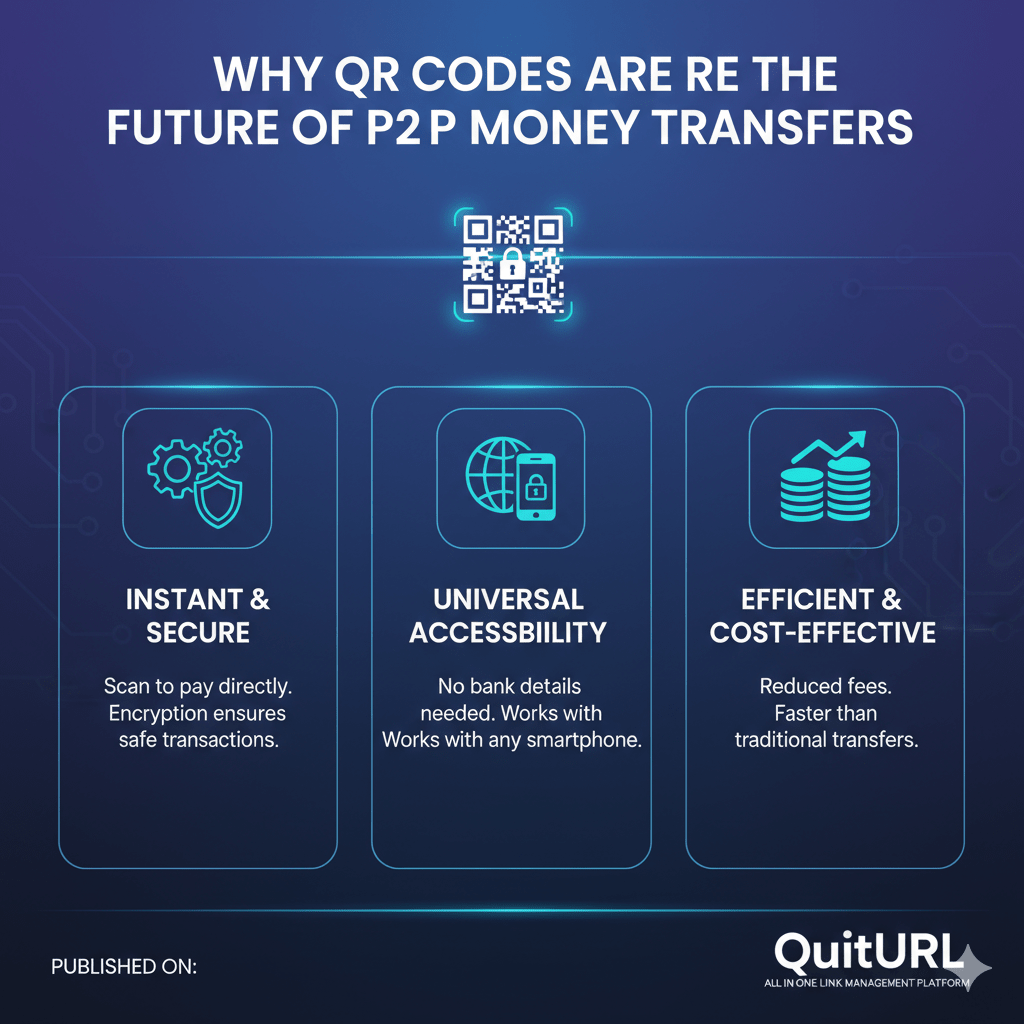

In today’s fast-paced digital world, people expect payments to be instant, secure, and effortless. That’s where QR Codes come in — offering a smooth way to send and receive money with just a quick scan. Whether you’re splitting a restaurant bill, paying a local vendor, or sending money to a friend, QR Code-based peer-to-peer (P2P) transfers make the process seamless.

Unlike traditional bank transfers or card payments, QR Codes eliminate friction and reduce the risk of errors. And with platforms like QuitURL, businesses and developers can easily generate custom, dynamic, and secure QR Codes for P2P payment systems — making transactions faster, more reliable, and globally accessible.

In short, QR Codes are shaping the future of P2P payments, and QuitURL stands out as the ultimate tool to create, manage, and track these codes with enterprise-level precision.

Why QR Codes Make P2P Transfers Easier and More Efficient

The rise of digital wallets and cashless ecosystems has changed how people handle money. But the success of P2P transfers lies in their simplicity — and QR Codes are the backbone of that transformation.

1. No Need for Account Details

With QR Codes, users don’t need to share bank account numbers or mobile numbers. Scanning a code instantly transfers payment details, reducing the chance of errors and increasing privacy.

2. Fast and Contactless

QR Codes allow instant, contactless payments. This became especially popular during the COVID-19 era, when physical cash exchanges were discouraged. The simplicity of scanning a code makes payments effortless.

3. Works Across Platforms

QR Codes bridge the gap between different payment apps. Whether you’re using PayPal, Google Pay, or a custom app, QR-based payments offer a universal, cross-platform experience.

4. Cost-Effective for Businesses

Generating a QR Code is inexpensive compared to setting up POS hardware. Businesses can print or display them digitally anywhere — at counters, websites, or receipts — and start accepting payments immediately.

In summary: QR Codes make P2P payments faster, safer, and simpler. With tools like QuitURL, generating these QR Codes for any payment platform takes just seconds.

Example Scenarios of P2P Transfers with QR Codes

Let’s explore how QR Codes are making daily money transfers more efficient and accessible for everyone.

1. Friends Splitting Bills

Imagine four friends at dinner. Instead of sharing bank details, one person generates a QR Code linked to their payment app. The others simply scan and send their share instantly. No confusion, no waiting.

2. Street Vendors and Small Merchants

Local vendors can display a QuitURL-generated QR Code to receive digital payments without expensive machines. It’s ideal for small shops, food stalls, and ride services.

3. Freelancers and Micro-Entrepreneurs

Freelancers can send QR Codes in invoices or business cards, letting clients pay instantly by scanning the code. It enhances professionalism and simplifies the transaction process.

4. Charities and Donations

Organizations can use QR Codes on posters, flyers, or websites to collect donations quickly. A single scan takes the donor directly to the secure payment page.

Real-world Example:

Apps like PayPal, Venmo, and Paytm already rely heavily on QR-based systems. Now, with tools like QuitURL, smaller businesses and startups can replicate this functionality affordably and securely.

How Businesses Can Implement QR Code P2P Payments

Implementing QR-based P2P payments is easier than it sounds — especially with an advanced generator like QuitURL.

1. Choose a Reliable QR Code Generator

Businesses should choose a QR platform that supports dynamic QR Codes, tracking, and security encryption. QuitURL offers all of these and more, making it ideal for fintech, e-commerce, and service-based companies.

2. Link to a Secure Payment Gateway

Each QR Code should redirect users to a secure payment page (like Stripe, Razorpay, or PayPal). QuitURL allows easy integration with these gateways via custom links or APIs.

3. Brand and Customize Your QR Codes

With QuitURL, you can add logos, brand colors, and custom frames to your QR Codes — building trust and improving recognition among users.

4. Test and Deploy Across Platforms

Before launching, test QR Codes across devices and payment systems. QuitURL’s real-time analytics help businesses monitor performance, user behavior, and scan sources.

5. Monitor and Optimize

QuitURL’s dashboard allows businesses to track scan rates, locations, and device data — enabling them to measure adoption and improve their QR Code campaigns.

Key Security and Compliance Considerations

As P2P payments become widespread, security and compliance are crucial for maintaining trust.

1. Data Encryption

QuitURL ensures that all QR Code links are encrypted and secure, preventing unauthorized access or tampering.

2. Avoid Static Payment Links

Static QR Codes can expose fixed data. Dynamic QR Codes (like those generated by QuitURL) allow updates, edits, and tracking without changing the printed code.

3. Fraud Prevention

QR Codes can include tracking features and expiration limits to prevent misuse. QuitURL also supports integration with secure APIs for real-time validation.

4. Compliance with Local Regulations

Different countries have varying digital payment laws. QuitURL allows custom domain usage and secure redirection to ensure compliance with region-specific requirements.

5. User Education

Encouraging users to scan QR Codes only from trusted sources helps prevent scams. Including branded elements and SSL-secured domains via QuitURL builds additional confidence.

Bottom line: QuitURL combines convenience with enterprise-grade safety — the perfect balance for businesses handling digital payments.

How to Maximize Adoption and Trust in P2P Transfers with QR Codes

Widespread adoption of P2P QR payments depends on trust, education, and user experience. Here’s how businesses and platforms can drive greater usage:

1. Focus on User-Friendly Design

Clear, readable, and branded QR Codes encourage trust. QuitURL allows you to create beautifully designed QR Codes that users instantly recognize as authentic.

2. Educate Users

Create guides or in-app tips explaining how QR payments work and their benefits. Transparency builds long-term trust.

3. Offer Incentives

Cashback offers, discounts, or loyalty points can motivate users to adopt QR payments faster.

4. Integrate with Multiple Platforms

QuitURL supports API-based integrations, letting your QR Codes work across mobile wallets, banking apps, and e-commerce systems.

5. Maintain Consistent Branding

Use your company logo and domain in all QR Codes. QuitURL’s custom domain and logo features strengthen your payment brand identity.

When businesses adopt these best practices, QR-based P2P payments not only grow faster but also become a trusted standard for digital money exchange.

Powering Smarter P2P Payments with QuitURL

At the heart of every seamless payment experience is technology that simplifies trust — and that’s exactly what QuitURL delivers.

1. Dynamic QR Code Creation

QuitURL lets users generate dynamic QR Codes that can be updated anytime — perfect for changing payment URLs, campaign links, or tracking purposes.

2. Real-Time Tracking

Monitor when, where, and how often your payment QR Codes are scanned. This data helps businesses understand payment behavior and optimize marketing strategies.

3. Multi-Platform Support

QuitURL-generated QR Codes work with all payment systems and mobile devices, ensuring a smooth experience for all users.

4. API Integration

Developers can use QuitURL’s API to automate QR Code creation within their apps or digital payment systems, enabling scalable fintech solutions.

5. Affordable and Scalable

From startups to enterprises, QuitURL offers pricing that fits every stage of business — without compromising speed, security, or quality.

QuitURL empowers modern businesses to adopt next-generation P2P payment systems with technology that’s reliable, data-driven, and user-friendly.

Why QuitURL Is the Best QR Code Generator

With countless QR generators online, what makes QuitURL the best choice for P2P money transfers?

1. Built for Businesses

QuitURL isn’t just a basic QR generator — it’s a professional-grade platform with features tailored for business, fintech, and marketing operations.

2. Security You Can Trust

QuitURL uses encrypted links, HTTPS redirection, and secure domain mapping to keep payment data safe.

3. Feature-Rich Platform

QuitURL includes:

- Dynamic & Static QR Codes

- Custom Domains

- Geo/Device Targeting

- A/B Testing

- Branded Designs

- Analytics Dashboard

- Team Collaboration

- API & Webhooks

4. Reliability & Uptime

With 99% uptime, QuitURL ensures your QR Codes work flawlessly anytime, anywhere — an essential factor for payment reliability.

5. Global Accessibility

QuitURL supports users from all countries and integrates smoothly with payment systems, e-commerce platforms, and SaaS tools.

In short, QuitURL is more than a QR Code generator — it’s a complete link management ecosystem, trusted by digital businesses worldwide.

FAQs

1. Are QR Codes safe for P2P money transfers?

Yes, QR Codes are safe when generated using secure platforms like QuitURL, which use encryption and SSL protection.

2. Can I use one QR Code for multiple transactions?

Yes. Dynamic QR Codes allow repeated use while updating payment information as needed.

3. Do users need special apps to scan QR Codes?

No. Most smartphone cameras support QR scanning natively, making it easy for anyone to send or receive payments.

4. How can businesses monitor QR-based payments?

QuitURL’s analytics dashboard provides real-time tracking, including scan location, device type, and usage frequency.

5. What makes QuitURL better than free QR Code tools?

QuitURL offers professional customization, analytics, security, and team collaboration — features most free tools lack.

Conclusion: The Future of Payments Is QR-Driven

As digital payments continue to evolve, QR Codes have proven to be the most efficient and inclusive way to handle P2P money transfers. They eliminate barriers, ensure security, and make transactions as easy as scanning a code.

Platforms like QuitURL are helping businesses and individuals unlock the full potential of this technology — with dynamic, secure, and analytics-powered QR Codes that redefine how money moves between people.

Whether you’re a fintech startup, small business, or large enterprise, QuitURL empowers you to deliver faster, smarter, and safer payment experiences — all while building trust with every transaction.